Vat On Second Hand Goods From Eu . margin scheme for public auctions. And what amounts to ‘a business’ for vat. Outside the uk to great britain. Vat is charged on all goods (except for gifts worth £39 or less) sent from: the margin scheme is a special vat scheme for entrepreneurs who trade in used goods. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. special rules apply when you buy goods from another eu country for delivery to your country of residence. this directive aims to supplement the common system of vat by establishing community tax arrangements.

from support.geekseller.com

this directive aims to supplement the common system of vat by establishing community tax arrangements. And what amounts to ‘a business’ for vat. Vat is charged on all goods (except for gifts worth £39 or less) sent from: check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. Outside the uk to great britain. the margin scheme is a special vat scheme for entrepreneurs who trade in used goods. special rules apply when you buy goods from another eu country for delivery to your country of residence. margin scheme for public auctions.

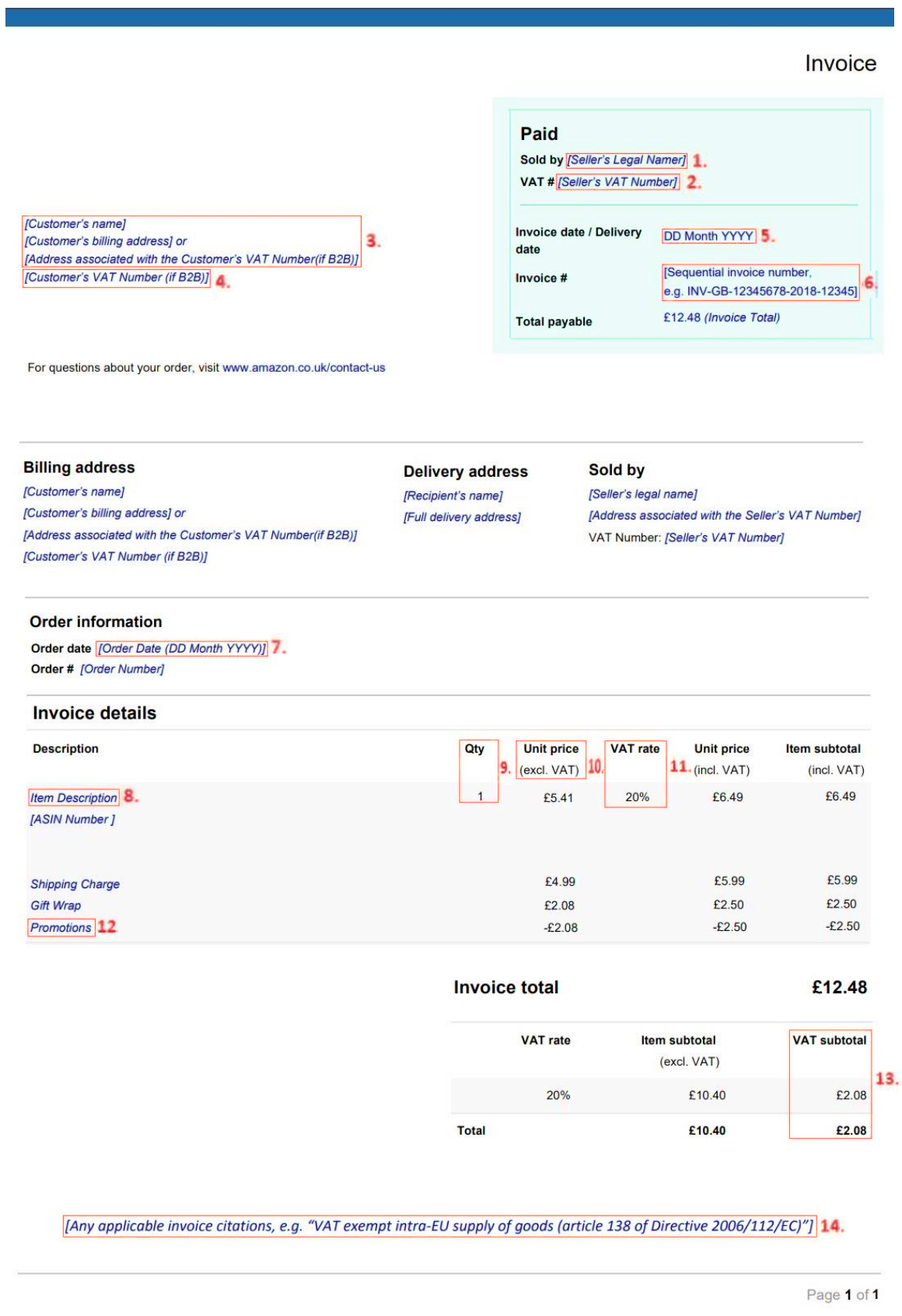

A ValueAdded Tax (VAT) Invoice GeekSeller Support

Vat On Second Hand Goods From Eu And what amounts to ‘a business’ for vat. the margin scheme is a special vat scheme for entrepreneurs who trade in used goods. And what amounts to ‘a business’ for vat. Vat is charged on all goods (except for gifts worth £39 or less) sent from: special rules apply when you buy goods from another eu country for delivery to your country of residence. margin scheme for public auctions. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. this directive aims to supplement the common system of vat by establishing community tax arrangements. Outside the uk to great britain.

From www.pwc.com

Chain transactions and VAT Vat On Second Hand Goods From Eu special rules apply when you buy goods from another eu country for delivery to your country of residence. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. this directive aims to supplement the common system of vat by establishing community tax arrangements.. Vat On Second Hand Goods From Eu.

From www.change.org

Petition · Abolish the 20 VAT on imported 2nd hand goods into the UK Vat On Second Hand Goods From Eu the margin scheme is a special vat scheme for entrepreneurs who trade in used goods. this directive aims to supplement the common system of vat by establishing community tax arrangements. Vat is charged on all goods (except for gifts worth £39 or less) sent from: special rules apply when you buy goods from another eu country for. Vat On Second Hand Goods From Eu.

From www.scribd.com

VAT 264 Declaration For The Supply of Second Hand Goods External Form Vat On Second Hand Goods From Eu And what amounts to ‘a business’ for vat. Vat is charged on all goods (except for gifts worth £39 or less) sent from: the margin scheme is a special vat scheme for entrepreneurs who trade in used goods. check if you need to pay import vat when you import goods into great britain from outside the uk, or. Vat On Second Hand Goods From Eu.

From osome.com

PostBrexit VAT Rules Services, Imports, Invoicing Vat On Second Hand Goods From Eu Outside the uk to great britain. And what amounts to ‘a business’ for vat. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. special rules apply when you buy goods from another eu country for delivery to your country of residence. margin. Vat On Second Hand Goods From Eu.

From hellotax.com

VAT rates in Europe 2020 Definition, Actual ValueAddedTax Rates Vat On Second Hand Goods From Eu this directive aims to supplement the common system of vat by establishing community tax arrangements. margin scheme for public auctions. Outside the uk to great britain. Vat is charged on all goods (except for gifts worth £39 or less) sent from: And what amounts to ‘a business’ for vat. the margin scheme is a special vat scheme. Vat On Second Hand Goods From Eu.

From www.chargebee.com

Taxes EU VAT Chargebee Docs Vat On Second Hand Goods From Eu special rules apply when you buy goods from another eu country for delivery to your country of residence. margin scheme for public auctions. the margin scheme is a special vat scheme for entrepreneurs who trade in used goods. And what amounts to ‘a business’ for vat. Outside the uk to great britain. this directive aims to. Vat On Second Hand Goods From Eu.

From cruseburke.co.uk

How Much is VAT in the UK Complete Guideline CruseBurke Vat On Second Hand Goods From Eu And what amounts to ‘a business’ for vat. margin scheme for public auctions. Vat is charged on all goods (except for gifts worth £39 or less) sent from: Outside the uk to great britain. special rules apply when you buy goods from another eu country for delivery to your country of residence. this directive aims to supplement. Vat On Second Hand Goods From Eu.

From www.sumup.com

Invoicing to EU businesses and VAT considerations after Brexit Vat On Second Hand Goods From Eu check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. special rules apply when you buy goods from another eu country for delivery to your country of residence. the margin scheme is a special vat scheme for entrepreneurs who trade in used goods.. Vat On Second Hand Goods From Eu.

From accotax.co.uk

VAT on buying goods from EU Accotax Vat On Second Hand Goods From Eu margin scheme for public auctions. Vat is charged on all goods (except for gifts worth £39 or less) sent from: the margin scheme is a special vat scheme for entrepreneurs who trade in used goods. Outside the uk to great britain. check if you need to pay import vat when you import goods into great britain from. Vat On Second Hand Goods From Eu.

From goselfemployed.co

VAT Margin Scheme for SecondHand Goods Vat On Second Hand Goods From Eu margin scheme for public auctions. the margin scheme is a special vat scheme for entrepreneurs who trade in used goods. this directive aims to supplement the common system of vat by establishing community tax arrangements. Vat is charged on all goods (except for gifts worth £39 or less) sent from: Outside the uk to great britain. . Vat On Second Hand Goods From Eu.

From www.accountinginspain.com

Amazon VAT Transactions Report explained Lexcam Tax Partners Vat On Second Hand Goods From Eu the margin scheme is a special vat scheme for entrepreneurs who trade in used goods. this directive aims to supplement the common system of vat by establishing community tax arrangements. special rules apply when you buy goods from another eu country for delivery to your country of residence. margin scheme for public auctions. And what amounts. Vat On Second Hand Goods From Eu.

From support.geekseller.com

A ValueAdded Tax (VAT) Invoice GeekSeller Support Vat On Second Hand Goods From Eu Outside the uk to great britain. margin scheme for public auctions. special rules apply when you buy goods from another eu country for delivery to your country of residence. the margin scheme is a special vat scheme for entrepreneurs who trade in used goods. Vat is charged on all goods (except for gifts worth £39 or less). Vat On Second Hand Goods From Eu.

From www.bdo.co.uk

VAT on selling direct to UK customers Brexit Tax Insights BDO Vat On Second Hand Goods From Eu Outside the uk to great britain. margin scheme for public auctions. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. Vat is charged on all goods (except for gifts worth £39 or less) sent from: this directive aims to supplement the common. Vat On Second Hand Goods From Eu.

From kpmg.com

VAT Matters Promo items & secondhand cars KPMG Ireland Vat On Second Hand Goods From Eu special rules apply when you buy goods from another eu country for delivery to your country of residence. Outside the uk to great britain. this directive aims to supplement the common system of vat by establishing community tax arrangements. And what amounts to ‘a business’ for vat. the margin scheme is a special vat scheme for entrepreneurs. Vat On Second Hand Goods From Eu.

From blog.shorts.uk.com

VAT on second hand goods explained Vat On Second Hand Goods From Eu Vat is charged on all goods (except for gifts worth £39 or less) sent from: margin scheme for public auctions. And what amounts to ‘a business’ for vat. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. Outside the uk to great britain.. Vat On Second Hand Goods From Eu.

From barn2.com

How to Provide EU VAT Tax Invoices in Easy Digital Downloads Vat On Second Hand Goods From Eu margin scheme for public auctions. special rules apply when you buy goods from another eu country for delivery to your country of residence. Outside the uk to great britain. Vat is charged on all goods (except for gifts worth £39 or less) sent from: check if you need to pay import vat when you import goods into. Vat On Second Hand Goods From Eu.

From ormerodrutter.co.uk

VAT changes when buying and reselling secondhand goods from the EU. Vat On Second Hand Goods From Eu the margin scheme is a special vat scheme for entrepreneurs who trade in used goods. And what amounts to ‘a business’ for vat. special rules apply when you buy goods from another eu country for delivery to your country of residence. margin scheme for public auctions. this directive aims to supplement the common system of vat. Vat On Second Hand Goods From Eu.

From www.accountingfirms.co.uk

VAT on SecondHand Goods Ultimate Guide AccountingFirms Vat On Second Hand Goods From Eu Outside the uk to great britain. Vat is charged on all goods (except for gifts worth £39 or less) sent from: margin scheme for public auctions. this directive aims to supplement the common system of vat by establishing community tax arrangements. special rules apply when you buy goods from another eu country for delivery to your country. Vat On Second Hand Goods From Eu.